Filing your tax return? Don’t these credits, deductions

amazon flex take out taxes Augustine Register

If you earned an extra $1,000, you will have to pay an additional 31.48% of that amount in tax, or $314.80. Free income tax calculator to estimate quickly your 2023 and 2024 income taxes for all Canadian provinces. Find out your tax brackets and how much Federal and Provincial taxes you will pay.

File Tax Return Stock Photography Image 23086762

For the 2023 tax year, prior to filing your tax return electronically with NETFILE, you will be asked to enter an Access code after your name, date of birth, and social insurance number. Your eight-character Access code is made up of numbers and letters and is located on the right side of your Notice of Assessment for the previous tax year.

How Federal Tax Rates Work Urban Institute

Personal income tax. Who should file a tax return, how to get ready for taxes, filing and payment due dates, reporting your income and claiming deductions, and how to make a payment or check the status of your refund.

Find Your WHY 2 Easy Ways to Discover Your Life’s Purpose

The training limit for most Canadians who are eligible for this credit is now $1,000 for 2023 which is up from its previous limit of $750 in 2022. You can find your Canada training limit on your 2022 Notice of Assessment. The Canada training credit is refundable, which means if your credit is higher than the amount of tax you owe, you get to.

How Much Tax Will I Pay On 41000? Update New

You can expect your return within two weeks and eight weeks when you file a paper return, as long as you file on time, according to the government. Non-residents, though, can expect a longer wait.

Filing your Tax Return in Canada Students Get 6000 Refund All

If you get a larger refund or smaller tax due from another tax preparation method, we'll refund the amount paid for our software. TurboTax Free customers are entitled to a payment of $9.99. Claims must be submitted within sixty (60) days of your TurboTax filing date, no later than May 31, 2024 (TurboTax Home & Business and TurboTax 20 Returns no later than July 15, 2024).

How to File Previous Year Tax Return File You Tax Return YouTube

How you file your return can affect when you get your refund. The CRA's goal is to send you a notice of assessment, as well as any refund, within the following timelines: online - 2 weeks. paper return - 8 weeks. non-resident returns - 16 weeks. These timelines apply only to returns that are received on or before the due date.

Check refund status browserguide

That means you will pay 15% in federal tax on your $50,000 of income—that's $7,500, not including deductions and claims of course. To give an another example, in November 2023, the average.

TAX RETURN text — Stock Photo © belchonock 148524647

From that point, the equation is: Step 1: total income - total deductions = taxable income. Step 2: taxable income x average tax rate = tax on taxable income. Step 3: tax on taxable income - (sum of all credits x 0.15) = tax payable. Step 4: tax payable - tax already paid + other refundable credits = refund.

upgraded! How much do I earn on my tax return? Time News

There are exercises available to test yourself on completing a basic tax return. Go to: Calculate a refund or a balance owing. Next: After sending us your tax return. Date modified: 2022-10-07. An introduction into filling out a Canadian income tax and benefit return which includes information on reporting income, claiming deductions and non.

Limit For Maximum Social Security Tax 2020 Financial Samurai

Use our simple 2023 income tax calculator for an idea of what your return will look like this year. Get a rough estimate of how much you'll get back or what you'll owe. Province Select Province* Alberta British Columbia Manitoba New Brunswick Newfoundland and Labrador Northwest Territories Nova Scotia Nunavut Ontario Prince Edward Island Québec Saskatchewan Yukon

Tax Return 2022 Direct Deposit Dates Latest News Update

2023 Income Tax Calculator. unsubscribe@hrblock.ca. At H&R Block, our Tax Experts make taxes simple. File your tax return the way you want and we'll get you your max refund. File in-office, online, or drop….

Money and Tax Return Tax Audit of a 1040 I am the designer… Flickr

2024 federal income tax rates. These rates apply to your taxable income. Your taxable income is your income after various deductions, credits, and exemptions have been applied. There are also various tax credits, deductions and benefits available to you to reduce your total tax payable. See how amounts are adjusted for inflation.

Printable Tax Extension Form

Plug in a few numbers and we'll give you visibility into your tax bracket, marginal tax rate, average tax rate, and payroll tax deductions, along with an estimate of your tax refunds and taxes owed in 2023. File your tax return today. Your maximum refund is guaranteed. Get started.

Don’t want to wait for your unemployment refund? Michigan suggests

Example: $40,000 (total income) - $5,000 (RRSP contributions) = $35,000 (taxable income) Calculate your total tax payable. Apply the appropriate federal and provincial tax rates to your taxable income, to determine your total tax payable. Example: For a taxable income of $35,000: Federal tax: $35,000 x 15% = $5,250.

What is a Tax Deduction? Definition, Examples, Calculation

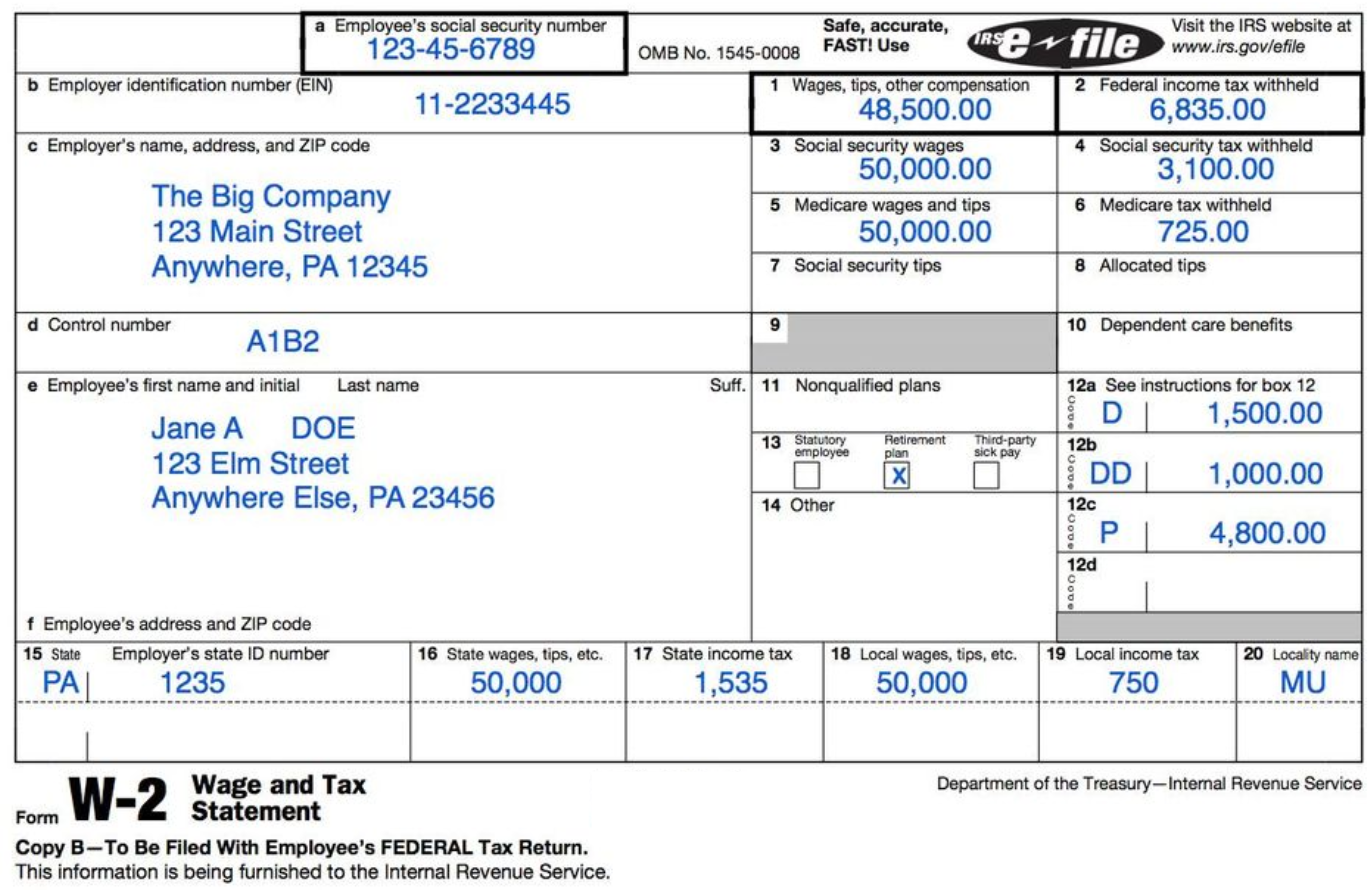

To complete your personal income tax return, the CRA requires certain personal information including your full legal name, address and social insurance number (SIN). You will also need to provide proof of all the income you earned during the tax year you're filing for. So, for example, for the 2023 tax year, you'll need to provide the CRA.

.